Ho–Lee model

In financial mathematics, the Ho–Lee model is a short rate model used in the pricing of bond options, swaptions and other interest rate derivatives, and in modeling future interest rates. It is the simplest model that can be calibrated to market data, by implying the form of  from market prices. Ho and Lee does not allow for mean reversion. It was developed in 1986 by Thomas Ho and Sang Bin Lee.

from market prices. Ho and Lee does not allow for mean reversion. It was developed in 1986 by Thomas Ho and Sang Bin Lee.

Model

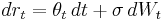

The short rate follows a normal process :

References

- T.S.Y. Ho, S.B. Lee, Term structure movements and pricing interest rate contingent claims, Journal of Finance 41, 1986. doi:10.2307/2328161

- John C. Hull, Options, futures, and other derivatives, 5th edition, Prentice Hall, ISBN 0-13-009056-5

External links

- Valuation and Hedging of Interest Rates Derivatives with the Ho-Lee Model, Markus Leippold and Zvi Wiener, finance.wharton.upenn.edu

|

|||||||||||||||||||||||